Section 179 Tax Benefits

Section 179 Tax Benefits

View Eligible Section 179 Vehicle Inventory

Go Commercial

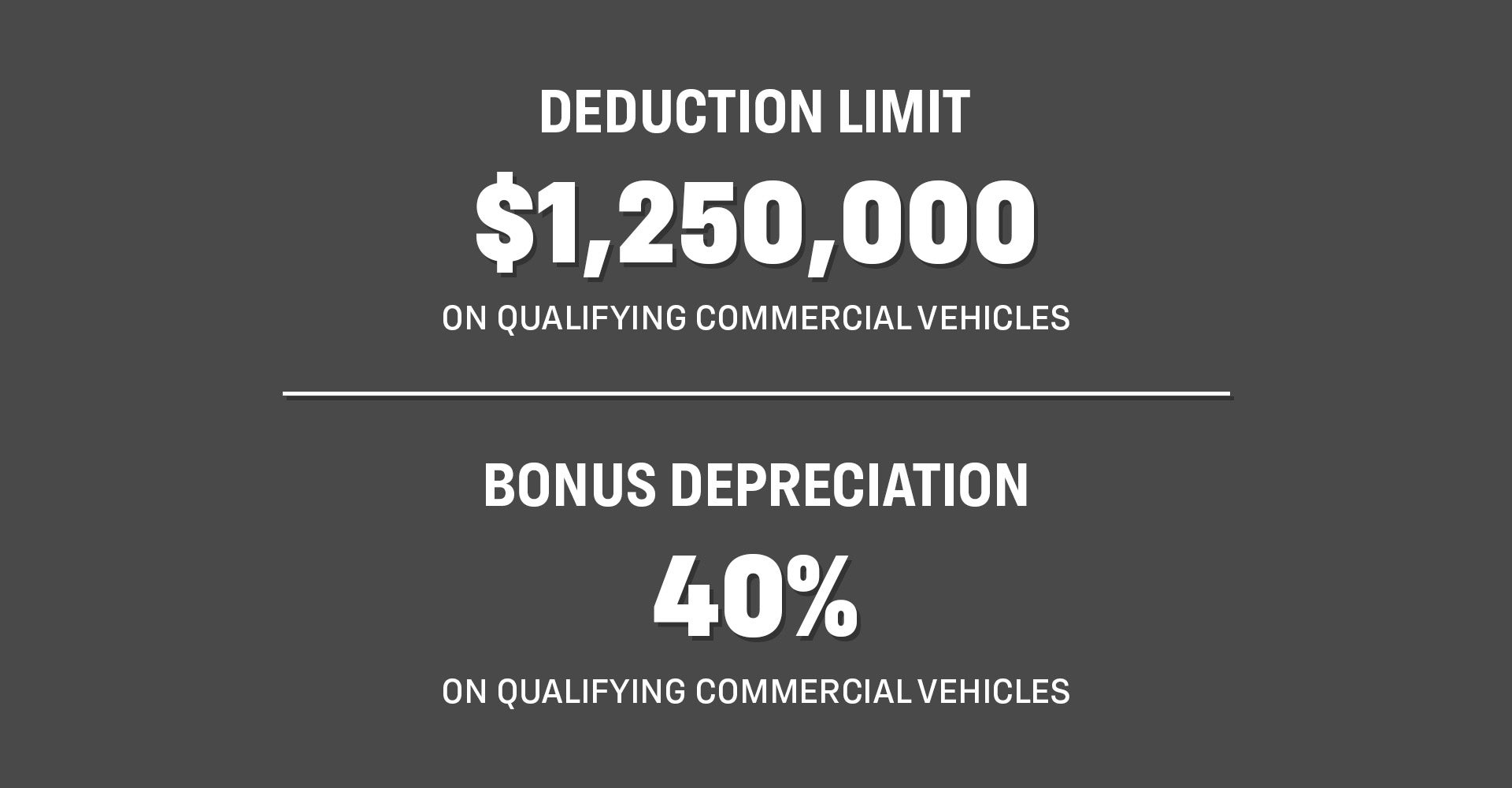

There are few better ways to expand your business than adding a fleet of commercial vehicles, perfect for transporting goods and completing tasks. At Aschenbach Chevrolet GMC, we offer high-quality commercial vehicles to suit our customer’s varying needs. We are also your go-to source for information on the Section 179 tax deduction. The Section 179 tax deduction is offered by the Internal Revenue Service (IRS) and allows businesses to deduct the full purchase price of qualifying equipment during a tax year.* Businesses can deduct up to $1,250,000 with a purchase limit of up to $3,130,000. Additionally, your business has the advantage of 40% bonus depreciation on new and pre-owned commercial vehicles. If you're seeking to buy an SUV for your business, the maximum deduction for SUVs placed in service in tax years beginning in 2025 is $31,300. Contact Aschenbach Chevrolet GMC to learn more about the Section 179 tax deduction and which vehicles qualify.

Eligible Vehicles

Interested in taking your business to the next level? Then you’re going to need capable work vehicles that can keep up with your day-to-day operations. To qualify for Section 179 tax savings, you must prove that the vehicle is being used for business purposes more than 50% of the time. Some qualifying vehicles you can find at our dealership include the Chevrolet Silverado, the Chevrolet Colorado, the GMC Canyon, and the GMC Sierra 1500. All of these models are extremely capable trucks with plenty of towing and hauling capabilities to their name. For even more power, check out the Chevrolet Silverado HD or the GMC Sierra HD models. If you need a van to help support your business that qualifies for the Section 179 tax deduction, check out the GMC Savana Passenger and Cargo vans or the Chevrolet Express vans.

Invest In Your Business

Have more questions about the Section 179 tax deduction? Visit Aschenbach Chevrolet GMC for information and to start shopping for your next commercial vehicle.

The Final Price excludes tax, title, license, optional equipment, and $999 processing fee. Freight is not included in the advertised pricing, cost may vary by model. Dealer sets the final price.

The Manufacturer's Suggested Retail Price excludes tax, title, license, dealer fees and optional equipment. Dealer sets final price.

More Info

| Monday | 8:30AM - 7:00PM |

| Tuesday | 8:30AM - 7:00PM |

| Wednesday | 8:30AM - 7:00PM |

| Thursday | 8:30AM - 7:00PM |

| Friday | 8:30AM - 7:00PM |

| Saturday | 8:30AM - 5:00PM |

| Sunday | Closed |

| Monday | 8:00AM - 5:00PM |

| Tuesday | 8:00AM - 5:00PM |

| Wednesday | 8:00AM - 5:00PM |

| Thursday | 8:00AM - 5:00PM |

| Friday | 8:00AM - 5:00PM |

| Saturday | 8:00AM - 2:00PM |

| Sunday | Closed |

| Monday | 8:30AM - 5:30PM |

| Tuesday | 8:30AM - 5:30PM |

| Wednesday | 8:30AM - 5:30PM |

| Thursday | 8:30AM - 5:30PM |

| Friday | 8:30AM - 5:30PM |

| Saturday | Closed |

| Sunday | Closed |

*See your tax professional for complete details.